Funding the Growth of American Entrepreneurship

Flexible Working Capital $500,000+

Lending through Partnership

Promotes Future

Bankability

Funding for now, fitness for the future.

Sawgrass Finance is a Northeast Florida asset-based lender that empowers a business owner to leverage their company’s liquid assets to secure a flexible line of credit without sacrificing equity ownership, customer perception, or future bankability.

Our hands-on partnership with business owners prioritizes continuous improvement and promotes long-term success.

Sawgrass proudly serves small, medium, and large businesses across Manufacturing, Wholesale/Distribution, Importers, Food & Beverage, Staffing Services, Apparel & Accessories, Logistics, Oil & Gas, Technology, and more.

Our Guiding Principles

Agile

Entrepreneurial

Collaborative

Forthright

You’ve got the goods. We’ve got the working capital.

Sawgrass Finance empowers a business owner to leverage liquid assets such as accounts receivable and inventory as collateral to secure a flexible line of credit.

Unlike other loan options, Sawgrass is collateral driven, takes no equity ownership, has no negative impact on customer perception, and promotes future bankability.

These and other advantages make Sawgrass ideal for quality businesses experiencing fast growth, insufficient cash flow, declining sales, financial losses, foreign ownership, seasonality and more.

How Sawgrass Serves You

Flexible Collateral

Prime-Based Interest

No Dilution of Ownership

4-6 Week Closing

No Annual Cleanup

Access to Decision Makers

No Harm to Reputation

Promotes Bankability

How Sawgrass Works

Sawgrass’s revolving line of credit is designed to sustain — and empower — constant changes in a business, unlocking additional working capital as demand grows.

Liquid Assets

Sales or Inventory Unlock Funds

Borrowing Power

Up to 85¢ per $1 Invoiced and 50¢ per $1 of Inventory

Advance rates subject to changeWorking Capital

Sawgrass Provides Cash Advance

Customer Payments

LOC Credited, Interest Reduced, and Additional Funds Unlocked

How Sawgrass Stacks Up

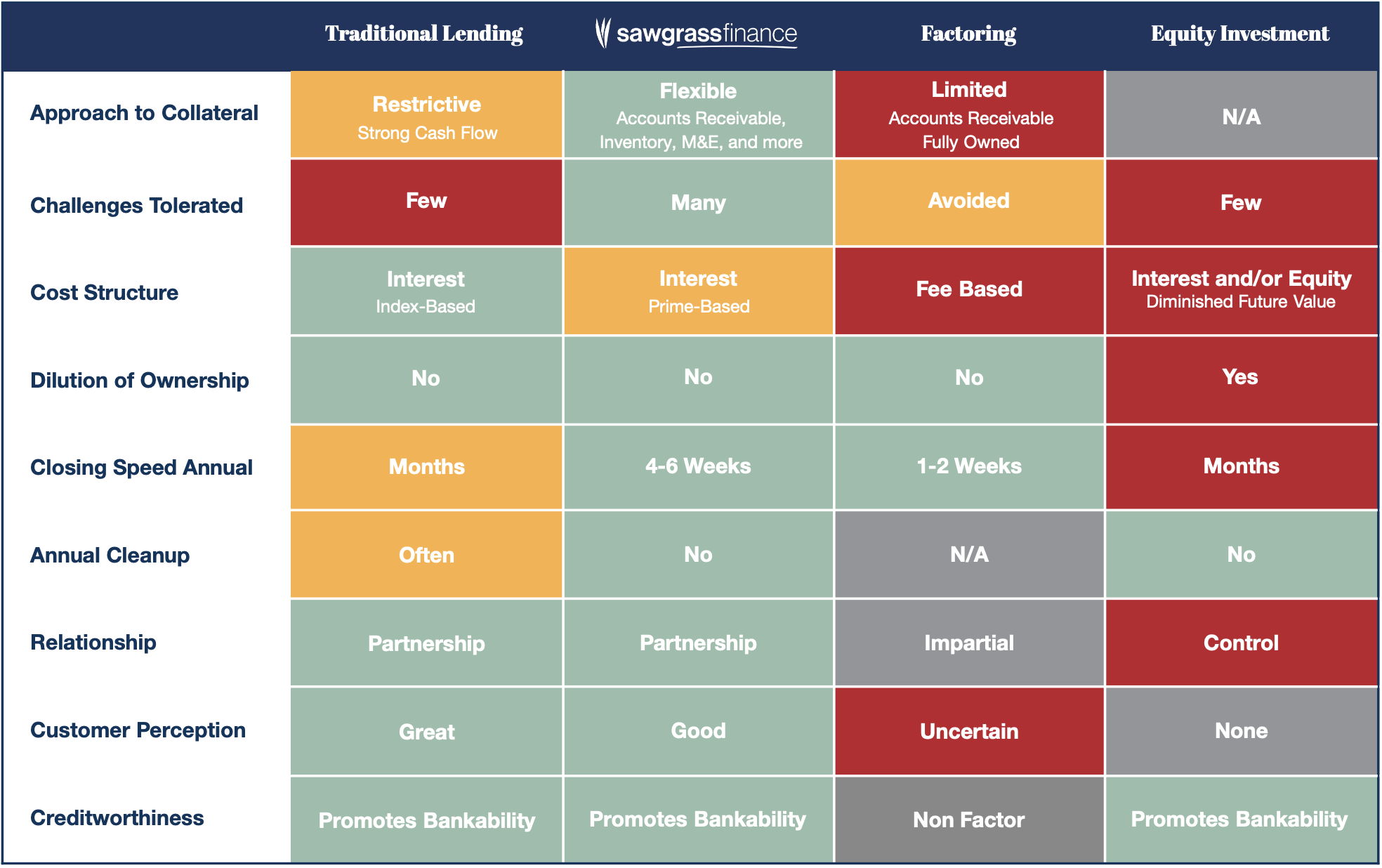

When compared to traditional lending, factoring, or equity investment, our Asset-Based Lending product offers significant advantages to business owners pursuing growth via leverage.

Your Able Credit Partner

Whether experiencing operational peaks or valleys, think of Sawgrass.

Opportunistic Times

Fast-Growing

Limited Track Record

Debtor Concentration

Needs Seasonal Accommodations

Foreign Ownership

In need of Flexible Working Capital

Challenging Times

Declining Sales & Trends

High Leverage

Negative Net Worth

Financial Losses

Insufficient Cash Flow

Inadequate Debt Service Coverage Ratio

Invest in Sawgrass

Verified investors are invited to view additional content in our password-protected Investor Briefing page.

To learn more about investing in Sawgrass Finance, contact Sawgrass President Marius Dobren.